How do you finance your home when interest rates hike?

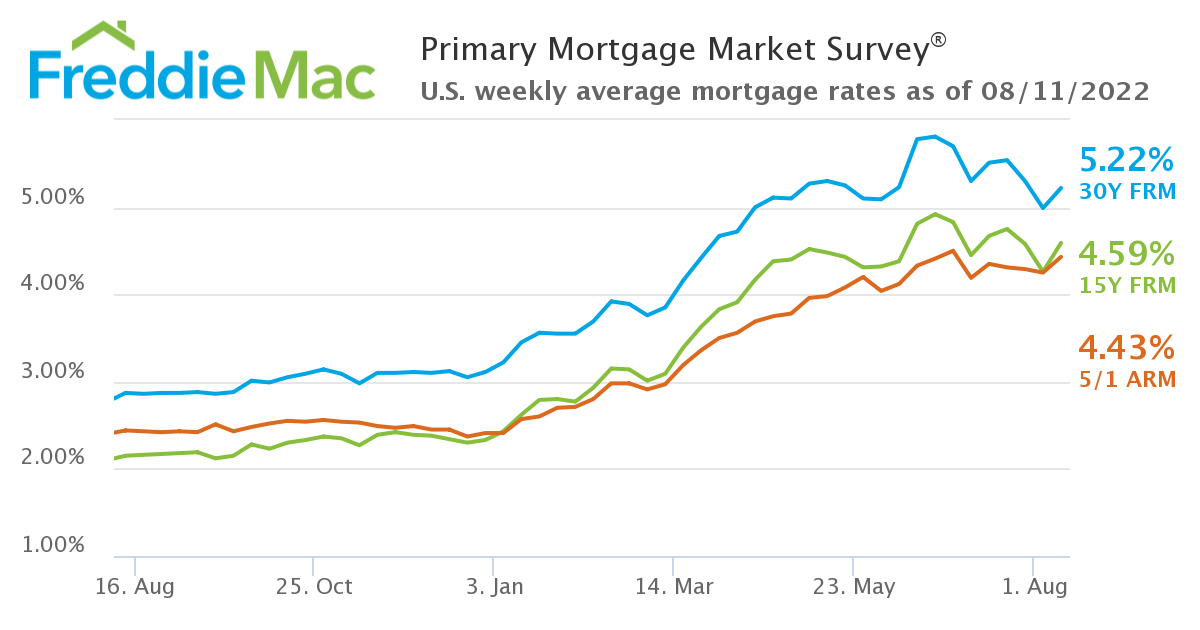

Since March 2022, the Federal Reserve (FED) has already increased its benchmark interest rate by 2.25 percentage points. FED actions impact mortgage rates. It's time for homebuyers and homeowners to look for other financing options besides the conventional fixed-rate mortgage loan.

Adjustable-rate mortgages

More and more purchasers are considering adjusting-rate mortgages (ARM) to fund their home purchases as ARM rates are typically lower than fixed rates. You can benefit from a cheaper ARM mortgage rate in two ways – either purchasing a home for the same amount as originally planned while paying a lower monthly mortgage or buying a more expensive home while keeping your monthly payment the same.

More and more purchasers are considering adjusting-rate mortgages (ARM) to fund their home purchases as ARM rates are typically lower than fixed rates. You can benefit from a cheaper ARM mortgage rate in two ways – either purchasing a home for the same amount as originally planned while paying a lower monthly mortgage or buying a more expensive home while keeping your monthly payment the same.

An ARM loan has an interest rate that is initially constant but fluctuates over time depending on the state of the market. For example, with a 10/6 ARM, your interest rate will be fixed for 10 years before adjusting every six months. Conversely, a 7/1 ARM means your interest rate will be fixed for the first seven years, after which it will adjust annually. Your fluctuating rate may end up being lower or higher depending on the market.

With fixed-rate mortgages, you are locked into the same interest rate for the entire loan life, which is usually 15 or 30 years. With an ARM, you will normally pay a lower interest rate during the fixed period than you would with a fixed-rate mortgage, enabling you to save money. Once the fixed period is over, if your fluctuating interest rate is lower, you will be better off. If your fluctuating interest is higher, your monthly mortgage will be higher. It is important to remember, however, that most adjustments have caps, meaning your rate will not be able to go up past a certain percentage or increase by more than a certain amount during each adjustment. Additionally, you always have the option of refinancing your mortgage if your rate rises above your expectations.

Home Equity Loans

Considering your options to pay for the monthly mortgage, home upgrades, starting a business, travel, debt consolidation, educational costs, or funding an emergency? Home equity loans are a great option for homeowners looking to take advantage of their home’s equity, which means homeowners borrow against the equity in their homes. The loan amount is determined by the difference between your home's current market value and your outstanding mortgage balance.

Considering your options to pay for the monthly mortgage, home upgrades, starting a business, travel, debt consolidation, educational costs, or funding an emergency? Home equity loans are a great option for homeowners looking to take advantage of their home’s equity, which means homeowners borrow against the equity in their homes. The loan amount is determined by the difference between your home's current market value and your outstanding mortgage balance.

Home equity loans come in two varieties – fixed-rate loans and variable-rate home equity lines of credit (HELOCs). A fixed-rate loan allows you to borrow a lump sum against your home equity at a fixed interest rate and with a set repayment term. With a HELOC, you are given a maximum amount that you can borrow based on the equity you have built in your home at a variable rate. HELOCs have a lot of benefits. They offer a quick source of money that can be used in an emergency. Because your property secures them, HELOCs often offer lower interest rates than those of credit cards and other consumer loans. You can decide to use all or part of your credit line, and you only pay interest on the money you have actually borrowed. So, if you have not used any of your credit lines, you will not be responsible for paying any principal or interest.

Reverse Mortgage

A homeowner 62 years of age or older with a sizable amount of equity in their property may borrow against it and receive cash as a lump sum, a set monthly payment, or a line of credit. In contrast to other mortgages, a reverse mortgage does not require the homeowner to make any loan payments. After the homeowner moves out or passes away, the home sale proceeds go to the lender to pay down the reverse mortgage's principal, interest, insurance, and fees. If the sale earnings are greater than the loan balance, the excess will be paid to the homeowner if they are still alive, or their estate if they pass away.

Posted by Leon Le on

Leave A Comment